Simple Steps To Help You Save for Your First Home

Turning a dream into reality starts with one thing: a plan. And if buying your first home is on your list of goals, now’s the perfect time to put a plan in motion to help you save.

And the best part? Reaching your savings goal doesn’t mean making huge sacrifices overnight – small, consistent steps can get you there over time. Here are a few strategies that can help speed up the process.

Step 1: Build a Budget That Works for You

Knowing where your money’s going is the first step to saving more of it. Take some time to track the money you’ve got coming in and going out. This helps you spot areas where you’re spending more than you realize. It also helps to give yourself some guidelines on what you want to spend for groceries, gas, and more – try to stick to whatever caps you put on each spending category.

Step 2: Cut Down on Any Extras (It Adds Up)

Once you’ve got a clear budget, it’s time to tighten up. Look for areas where you can cut down your costs – like services you don’t really need – or ways you can reduce recurring expenses and put that money in your house fund instead. Every dollar you save now brings you closer to your future house. As Bankrate says:

“If you’re saving for a house, cutting back on your spending can help. Start with cutting unnecessary expenses, like subscription services, entertainment, delivery services or eating out. If possible, negotiate down recurring monthly or annual expenses, such as getting a better car insurance rate or reducing an internet bill . . . .”

Step 3: Automate Your Savings

Consistency is the real game-changer. If you have to transfer money manually, you may forget to do it. That’s why setting up automatic transfers to a dedicated savings account makes it easier to save regularly. Even apps that round up purchases to the nearest dollar and save the difference can help you build momentum without effort. As an article from Forbes explains:

“Automating your savings helps to keep your progress toward your goal consistent. Set up automatic transfers from your checking account to a dedicated savings account. This will help you prioritize saving and minimize the chances of spending your money on other things.”

Step Four: Put Any Extra Money To Work

Got a tax refund, work bonus, or a cash gift? Don’t fall into the temptation to spend it on something you don’t actually need. Use those unexpected boosts to make big strides toward your savings goal. Treating this extra cash as an opportunity, not just a nice surprise, will help you get there faster.

Bottom Line

Saving for your first house isn’t about perfection – it’s about progress. A solid plan, a little discipline, and a clear goal will take you further than you think. If you’re ready to make homeownership happen, let’s connect. We’ll map out the next steps together to get you closer to the keys to your first home.

Richard Iarossi, REALTOR®

Coldwell Banker Realty

1300 Main Chapel Way

Gambrills, MD 21054

443-995-9595 Cell

410-721-0103 Office

richsellshomes.com

rich@richsellshomes.com

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

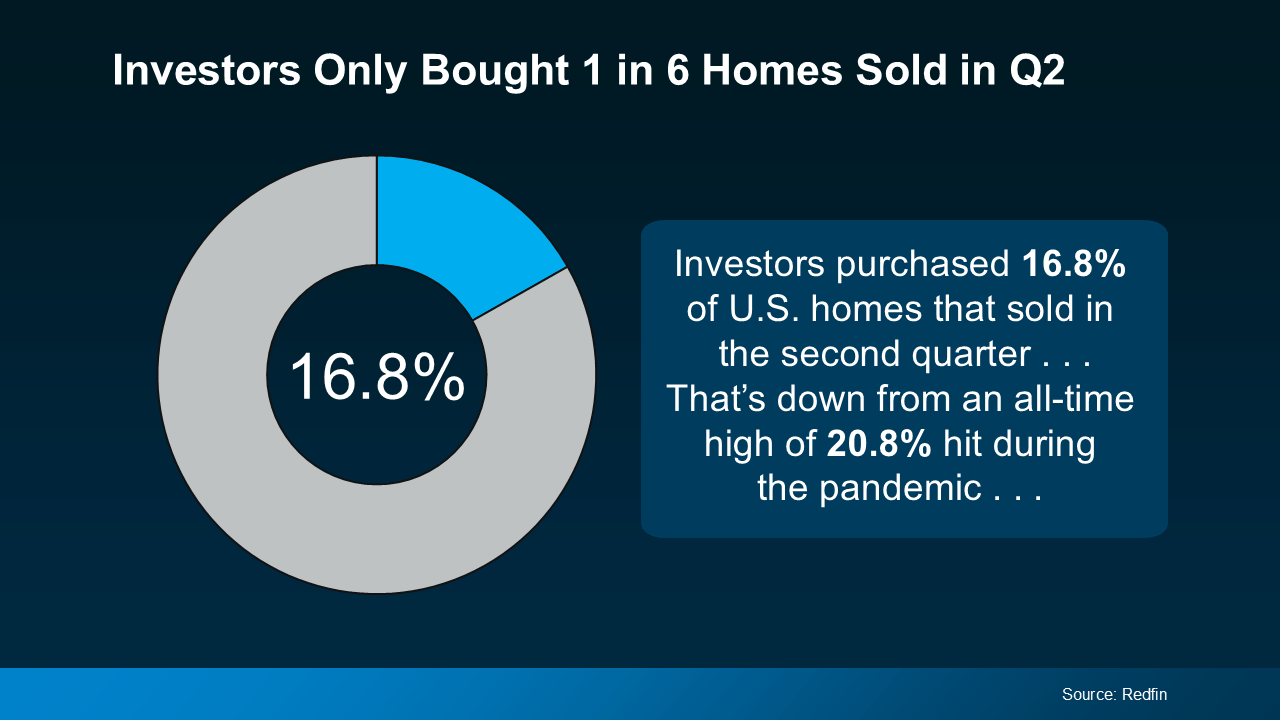

Here’s what that means. Five out of every six homes are being purchased by everyday

Here’s what that means. Five out of every six homes are being purchased by everyday